The unemployment rate in the U.S. hit 4.2% in September 2017, according to Bureau of Labor Statistics. This is the lowest it’s been in a decade, since the start of the Great Recession. While a low unemployment rate is important, rising incomes matter more for American families. SmartAsset examined the most recent income data to find the U.S. cities with the fastest-growing incomes.

Check out the best savings accounts.

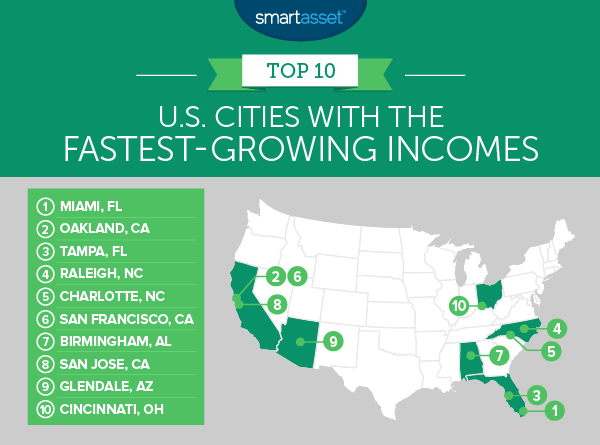

In order to find the cities with the fastest-growing incomes, SmartAsset analyzed median household income data from 2015 and 2016. Check out our data and methodology section below to see where we got our data and how we put it together.

Key Findings

- Incomes are up – Generally speaking household incomes across the country are up. In only 11 of the largest hundred cities did the average household income drop. In seven of those 11 cities the percent decrease in incomes was less than 1%. There were only three cities where the economic situation looked distressing. In El Paso, Texas, Cleveland, Ohio and Baton Rouge, Louisiana incomes dropped by over 4%.

- What happened in Washington D.C.? – For the first time in 10 years, incomes fell in the nation’s capital. From 2005 to 2015 median household incomes in Washington, D.C. rose by $30,000, going from $47,221 to $75,628. However from 2015 to 2016, incomes dropped slightly from $75,628 to $75,506.

- STEM jobs – Five of our top 10 cities with the fastest-growing incomes are tech hubs. Oakland, Raleigh, Charlotte, San Francisco and San Jose all have booming tech sectors and the rising income numbers show it.

1. Miami, Florida

Miami households started 2015 with an average income just shy of $30,000. By 2016 this figure had risen over 16% – the most in our study – to $34,900. Admittedly $34,900 is still far below the U.S. average of $57,000, but a 16% raise over one year is a step toward fixing that.

When you also consider the fact that Florida has no income tax, you can bet Miami households have a smile on their face.

2. Oakland, California

Oakland benefits from being located near one of America’s most productive areas, Silicon Valley. With the availability of high-paying tech jobs, it’s not too surprising that incomes in Oakland have risen. Data from the Census shows that from 2015 to 2016, the median household income in Oakland went from $58,800 to $68,000. That’s an increase of 15.7%.

Residents on Oakland may want to keep an eye on rent costs eating into their incomes though. The average rental in Oakland costs over $1,300, a number which rose 5% from the previous year.

3. Tampa, Florida

Another Florida city takes third. The average household here received a raise of around $6,000, going from earning $44,000 to $50,000. That raise will make saving for retirement a little easier for Tampa residents.

However like Oakland, Tampa residents are also facing increasing rent costs. The median rent in Tampa is up just under 10%.

4. Raleigh, North Carolina

Raleigh is the first of two North Carolina cities in our top five. A large chunk of economic prosperity in Raleigh comes from the fact that it’s the capital of North Carolina. Just over 24,000 workers in Raleigh are employed by the state of North Carolina.

The city is also part of North Carolina’s Research Triangle which brings high-paying STEM jobs into the area. Overall incomes rose 13% from 2015 to 2016.

5. Charlotte, North Carolina

Charlotte is home to the third-largest financial sector in the country. Bank of America, the second-largest financial institution in the U.S., is based in Charlotte. The Queen City is also the eastern headquarter for Wells Fargo and employs over 22,000 people in the city.

Working in finance tends to pay well but just about everyone across Charlotte seems to be doing better. The average Charlotte household saw incomes rise from $54,000 to $61,000.

6. San Francisco, California

San Francisco households were already some of the highest earners in 2015. And thanks in part to the high paying tech jobs, that income growth is not slowing. The average household in San Francisco in 2016 earned almost $104,000, up about $12,000 from 2015.

The other piece of good news for SF residents is that incomes are growing faster than those rents. From 2015 to 2016, Census data showed that the median rent rose about 7.5%.

7. Birmingham, Alabama

On average Birmingham residents earn less than their neighbors throughout Alabama. But that may change in the coming years. From 2015 to 2016 Birmingham’s median household income grew 12%, or by $4,000. The rest of the state of Alabama only saw incomes grow by about $2,000.

For Birmingham households who recently received a raise and are looking to buy a home there is some good news. Alabama has some of the lowest property taxes in the nation so the long-term cost of owning a home in Alabama is lower than it is in other states.

8. San Jose, California

This study shows just how powerful STEM jobs can be to a local economy. Another Silicon Valley city, San Jose, ranks eighth. From 2015 to 2016 the average household in San Jose got a raise of over $10,000, or 12.7%. San Jose’s cost of living is high so that extra income will come in handy. Our data shows that median rents jumped 9% from 2015 to 2016.

9. Glendale, Arizona

In one sense Glendale households may actually be feeling richer than some of the other cities ahead of it on this list. Median incomes in Glendale grew 11%, the ninth-highest rate, but median rents only rose 4.5%. This means a smaller percent of Glendale’s residents budgets are going toward housing.

10. Cincinnati, Ohio

Closing out the list is a Midwest city. From 2015 to 2016 the median household in Cincinnati saw their income rise from $35,000 to $38,500. That is a percent increase of about 10%.

Data and Methodology

In order to find the cities with the fastest rising incomes, SmartAsset analyzed data for the largest 100 cities in the country. Specifically, we looked at data for the following two metrics:

- 2015 median household income. Data comes from the 2015 1-year American Community Survey.

- 2016 median household income. Data comes from the 2016 1-year American Community Survey.

After finding data for the 2015 median household income and 2016 median household income, we found the percent change from 2015 to 2016. We ranked the cities from largest percent increase from 2015 to 2016.

Tips for Asking for a Raise

According to Glassdoor, 31% of employees believe they don’t receive fair pay. If you are among that group, here are some tips for asking for a well deserved raise.

- Make sure you do your homework. When you ask for a raise you want to make sure you are prepared. This means having a good idea of what other people in your industry with your experience are paid. Even if you deserve a raise you may not get it if you cannot make a good case for yourself. You are your number one advocate so make sure you have a good pitch ready to sell your boss. Somethings to consider in your pitch include: How replaceable are you? Do you have unique skills in your office? The idea is to show that you are a unique asset to the company and deserved to be paid as such.

- Timing is important. Regardless of how well you are performing, asking for a raise a bad time may hurt your chances. Generally, you want to ask for a raise when the company is doing well. If your company is losing money, odds are, no matter how strong of a worker you are, you won’t be getting that raise.

- Finally, don’t get discouraged. Even if your initial requests for a raise are rebuffed you can still learn vital information. Ask your boss why they don’t think you are deserving of a raise. You can then use that information to get a raise next time around.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock.com/lzf