Stock advisor websites for investors provide useful tools, research, and information on markets and individual securities. These sites offer stock screeners to identify opportunities, articles analyzing specific companies, model portfolios showing how to construct a diversified mix of holdings and communities to exchange ideas. Because different sites offer different tools and philosophies it’s important to find the one that best fits your investment strategy.

A financial advisor can show you how to utilize online tools and trackers to make the most of your portfolio investments.

What Stock Advisor Websites Do

Stock advisor websites help average investors learn how to invest money into stocks. They can show people which undervalued stocks offer the best potential for returns, and also point out the stocks at risk of losing the most money. Several allow you to search for stocks meeting certain criteria important to you.

Many advisor platforms provide model investment portfolios to demonstrate methods for mixing different types of investments. Additionally, these sites frequently have investment tips and educational resources for beginners. On sites that allow users to exchange messages, the online communities that develop can provide insight and peer support.

5 Stock Advisor Websites

The quality and focus of stock advisor websites can vary widely. Some supply broadly applicable content generated by experienced professionals and vetted by experts. Others may consist of the uninformed ramblings of amateurs, often on topics of little interest to average investors. It’s important for investors to be able to tell the difference. To start, here are five popular stock advisor websites for investors.

Morningstar Investor

This one offers easy-to-use stock screening tools to build portfolios matching your strategy. Morningstar’s analyst ratings on index funds and stocks enable investors to hone in on highly-rated names.

The Motley Fool

Known for providing a range of insights across many categories and themes. Motley Fool’s Stock Advisor service claims its recommendations have quadrupled the S&P 500 earnings since 2004. Beginners benefit from Motley Fool’s plain language education.

Dividend.com

Complete information on dividend-paying stocks makes this site appealing to investors pursuing income strategies. Easily see upcoming dividend payout dates, amounts and a company’s history of rising dividends.

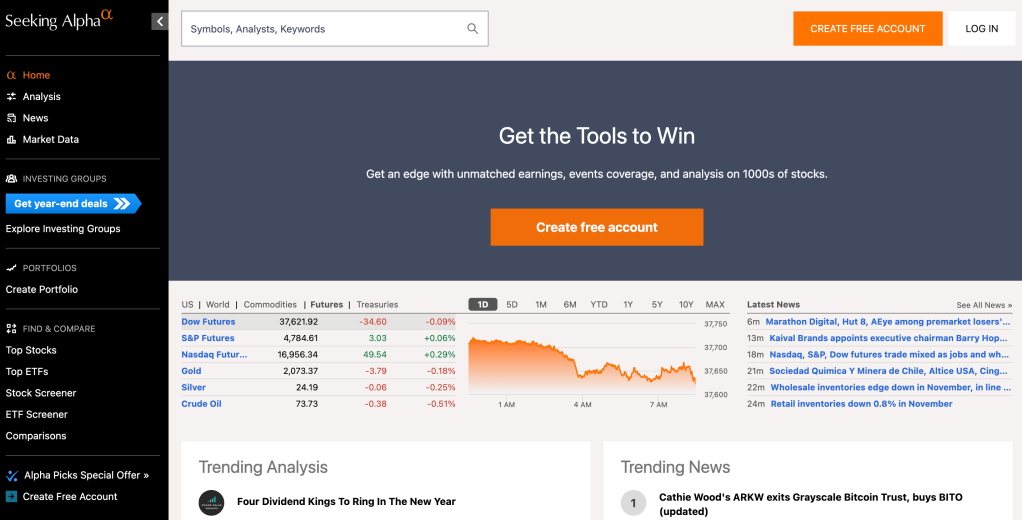

SeekingAlpha

A good source of numerous articles doing deep dives analyzing individual stocks, SeekingAlpha’s marketplace of contributors results in a wide range of recommendations. Like The Motley Fool, it offers its own premium service that has outperformed the S&P 500 returns for several years in a row.

ValueInvesting.io

Value investors are likely to appreciate this site’s estimated fair values of stocks calculated from discounted cash flows. Users can modify assumptions like growth rates to model different scenarios.

When Stock Advisor Sites Fall Short

Although advisor websites provide useful input and ideas for stock research, context matters. If a site concentrates on one philosophy like value metrics or dividends, for instance, it may not present other viewpoints. And while many sites provide free information, this isn’t always the case. Some platforms price premium memberships at well over $100 monthly which limits their accessibility for many beginning investors.

. And, as is always the case, past performance doesn’t predict future returns. Eye-catching claims of huge returns could have been due to positive market trends and good luck more than stock-picking skill. Following their model investment portfolios too closely carries risks, too, especially if they don’t align with your other goals.

Choosing Stock Advisor Websites

Rather than relying on a single stock advisor platform, consider utilizing multiple sites. Try to identify sites that offer different perspectives and complimentary tools that cater to the type of investments you actually make.

For instance, value investors can leverage Morningstar ratings plus ValueInvesting.io’s cash flow estimates. Income-focused investors may couple Dividend.com for payout details with Motley Fool recommendations across sectors. Newcomers seeking education plus stock ideas can turn to Motley Fool and SeekingAlpha articles.

Check a potential stock pick against various sites to generate a balanced view of its prospects. Think of it as talking to a range of experts rather than listening to just one voice. Investors should ultimately analyze stocks independently too, instead of blindly following advisors without question.

Key Features to Look for in a Stock Advisor Site

Not all stock advisor websites are created equal. While some are packed with advanced tools and deep research, others may offer limited functionality or focus on narrow investment strategies. To make the most of these platforms, look for the following key features:

- Robust Stock Screener Tools: A powerful screener allows you to filter stocks by criteria such as market cap, dividend yield, price-earnings ratio, sector and more. This can help you pinpoint investment opportunities that fit your goals and strategy.

- Analyst Ratings or Community Ratings: Sites like Morningstar provide professional analyst ratings, while others like SeekingAlpha offer crowd-sourced or contributor-based evaluations. Both can be useful in forming a well-rounded view.

- Model Portfolios and Allocation Suggestions: These can provide inspiration and guidance, especially for newer investors. A good platform will explain the reasoning behind its asset allocation and how it aligns with various risk levels or investment goals.

- Alerts and Watchlists: Real-time or customizable alerts can help you monitor your watchlist, react to breaking news or get notified when a stock meets specific criteria. These tools are especially helpful for active traders.

- Access to Analyst Research or Earnings Calendars: Premium sites often provide access to professional research reports, earnings transcripts, upcoming financial event calendars and other critical resources for informed investing decisions.

How to Choose the Right Stock Advisor Website for You

Choosing a stock advisor website is not a one-size-fits-all decision. The best site for your needs will depend on your investing experience, goals and budget. Here are a few key considerations to guide your selection:

- Experience Level: Beginners may benefit from platforms like The Motley Fool or Morningstar, which offer easy-to-understand guidance and educational content. More advanced investors might gravitate toward sites like SeekingAlpha or ValueInvesting.io, which provide deeper analysis and customizable models.

- Investment Goals and Time Horizon: Some platforms cater to long-term investors looking for steady growth or dividend income, while others focus more on short-term trading and market momentum. Make sure the site’s investment philosophy aligns with your own.

- Strategy Alignment: If you’re a value investor, a site offering fundamental metrics and fair value estimates may be more helpful. For dividend-focused investors, tools that highlight payout history and yield trends are essential.

- Budget and Subscriptions: Many stock advisor platforms offer a mix of free and premium content. Consider whether the site’s paid features justify the cost based on your needs. Some charge over $100 per year, or even per month, so it’s important to evaluate the return on investment.

- Tech Features and Accessibility: Look for platforms with well-designed mobile apps, real-time alerts, browser-based dashboards, and educational tools. These features can enhance your experience and make it easier to act on investment opportunities.

Bottom Line

Stock advisor websites supply individual investors helpful services like screening for opportunities, evaluating stocks and presenting model portfolios. Leading platforms providing valuation estimates, risk assessments, and diverse opinions can further contribute to your success. However only depending on simple stock picks or ignoring the bigger picture can mean missing out. Checking multiple trusted sites while staying thoughtfully engaged helps everyday investors get all they can from these powerful online tools.

Investment Tips for Beginners

- A financial advisor can suggest reputable online stock information providers with options tailored for you and supply hands-on, personalized advice. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Project how much your portfolio will be worth over time using SmartAsset’s investment growth and return calculator.

Photo credit: ©iStock/Milan_Jovic, ©iStock/Morningstar Investor, ©iStock/The Motley Fool, ©iStock/Dividend.com, ©iStock/SeekingAlpha, ©iStock/ValueInvesting.io, ©iStock/BalanceFormcreative