Chicago: The Windy City. Famous for its architecture and its deep-dish pizza, it has a lot to offer visitors and residents alike. This top-five-largest city in the US is also known as the “Jewel of the Midwest.” But if you’re thinking of making a move to Chicago, you should understand the true cost of living there.

If you’re planning a big move, there are many financials items to consider. Speak with a financial advisor about them today.

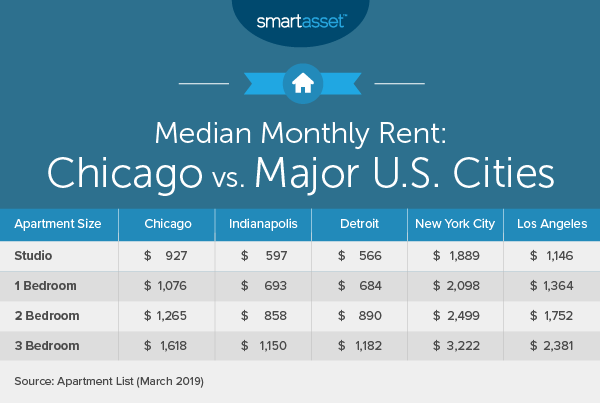

Renting Costs in Chicago

Chicago may rival New York in terms of architectural splendor, but the Windy City is considerably cheaper when it comes to rent prices. And that’s a good thing for the overall cost of living in Chicago.

According to March 2022 data from Apartment List, the median rent for a one-bedroom apartment was $1,285 and for a two-bedroom apartment it was $1,416. These prices are close to the national average of $1,306 but lower than some other large cities like New York, Los Angeles and San Francisco.

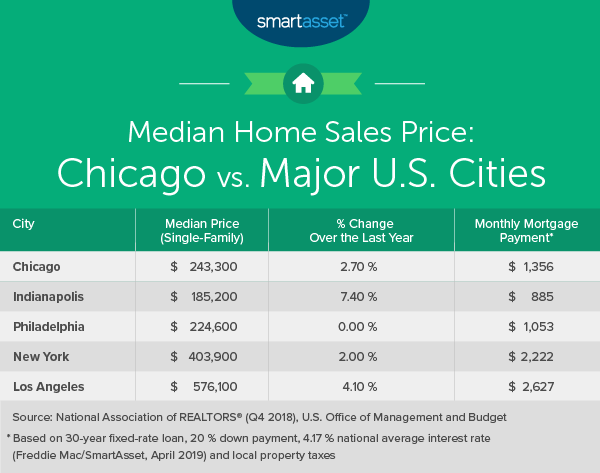

Chicago Home Prices

The cost of buying a home in Chicago isn’t terribly expensive. This is likely due to the extreme fall of real estate prices during the market crash in 2008. Since then, however, prices have rebounded fairly well, especially by in-state standards.

The median price for a home in the Chicago area in the fourth quarter of 2021 was $318,100, up 8.9% from the previous fourth-quarter median price, according to the National Association of Realtors. That contrasts with the national median price for a home of $353,800, a 13.8% increase over the previous national fourth quarter median price.

By contrast, the median price for homes in the New York City area rose 13.3% in the fourth quarter of 2021 to $544,900 and in San Francisco the comparable metric was $1.31 million, a gain of 14.9%. So although Chicago is one of the largest cities in the U.S., its housing market is still fairly cheap.

Are you ready to commit to a mortgage? If so, you may want to talk to a financial advisor about how these new payments could affect your financial life in its entirety.

Utilities

Utilities come into play regardless of whether you rent or buy. According to April 2022 reports from Numbeo.com, a basic utilities package of electricity, heating, water and garbage costs $169.96 in Chicago. If you add in internet, your combined bill will be around $228.53. That’s below the national average of $237.79.

The downside of living in Chicago is the special “Cloud Tax” you’ll have to pay for online streaming services. It’s a 9% surtax on the cost of services like Netflix. While the signing of this tax into law was met with resistance, it has withstood a lawsuit from the Liberty Justice Center in 2018.

Transportation

Chicagoans who don’t have cars rely on a combination of bus and subway services. An unlimited monthly pass from the Chicago Transit Authority costs $75. That’s $25 more than the same pass in Los Angeles, though LA’s prices were set to rise in July 2022 to $100 for a 30-day pass. In New York City a similar pass cost $127.

If you decide you can’t get by without a car, you’ll have to pay for one of Chicago’s City Vehicle Stickers. This annual expense ensures your compliance with the city’s Wheel Tax. For a regular-sized passenger car, the sticker will cost you $95.42. Got an SUV or a mid-sized van? Expect to pay $151.55.

Once you’ve paid for your vehicle sticker you’ll be ready to hit the road. But what about gas prices? According to AAA data from April 2022, you can expect to pay $4.80 for a gallon of regular gasoline in Chicago. That’s about 66 cents above the national average of $4.14.

Food Prices

With the essentials of housing, utilities and transportation covered, that leaves food. According to Numbeo.com, a three-course meal for two in a mid-range Chicago restaurant will cost you $80. A meal at an inexpensive Chicago restaurant costs just $16.50.

Whether you go fancy or no-frills, you’ll pay a series of taxes on the experience. There a 1.25% meals tax in Chicago and another 1.25% tax levied by Cook County. Further, there’s a Regional Transportation Authority tax on food levied by Cook County of 1%. There’s also a 1% tax by the Metropolitan Pier and Exposition Authority tax. All of these taxes are on top of the state restaurant food tax of 6.25%, bringing the total tax on eating in a Chicago restaurant to 10.75%.

Taxes

In addition to the aforementioned meals tax, Illinois is one of only 13 states to tax groceries. However, in the spring of 2022 the state’s 1% groceries tax was suspended temporarily. Illinois has the second-highest property taxes in the nation. The statewide average effective property tax rate is 2.27%, which is almost twice the national average.

When it comes to income taxes, Chicago keeps things simple. Illinois has a flat income tax of 4.95%.

Entertainment

Chicago isn’t lacking in entertainment options. There’s the famous Lollapalooza music festival every summer, the improv institution Second City and, for traditionalists, the Chicago Symphony Orchestra, one of the “Big Five” American orchestras.

If you’re a sports fan, you can head to Wrigley Field to catch a Cubs game for an average ticket price of $83. Or you can go over to the South Side to see the White Sox. White Sox tickets are a better deal than Cubs tickets. In fact, according to Statista’s 2018 report, Cubs tickets are the most expensive in baseball. For a White Sox game, the average is $55. Of course, ticket prices inherently vary on a game to game basis.

Prefer basketball? According to Statista, the average ticket price to see the Bulls for the 2022 season was $82.

Miscellaneous Cost of Living Facts

Chicago has plenty of free attractions to check out. How about a walk along the shore of Lake Michigan, a picnic in Millennium Park or a visit to the Lincoln Park Zoo? When you get tired you can check out the campus of the University of Chicago or take a stroll through Wicker Park. Just make sure you bring a warm coat if it’s winter. Although the origin of the nickname “Windy City” has nothing to do with the weather, Chicago is in fact a windy place.

Next Steps for Your Move to Chicago

- Moving to a new city can have a big impact on your finances, especially if you’re buying a new home. To get some help, it might be worth consulting with a financial advisor.

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Being that Chicago is a major U.S. city, there are tons of new banks to pick from. To get your search started, here are a few options: Old Plank Trail Community Bank, Mercantile Bank, First Savings Bank of Hegewisch, FCB Banks and The Bank of Edwardsville.

Photo credit: © iStock/Sean Pavone, SmartAsset.com, SmartAsset.com, © iStock/marchello74